The Indian stock market ecosystem is marked by its depth, transparency and great participation from both retail and institutional investors. There are two strong exchanges at the centre of this ecosystem the Bombay Stock Exchange, popularly known as BSE, and the National Stock Exchange, known as NSE. Therefore, to understand how the market functions, it is important to realise the role of BSE and NSE in trading. These exchanges serve not only as a meeting place for buyers and sellers of securities but also define the structure, stability, and efficiency of India’s financial markets.

It supports the role of BSE and NSE in trading: price discovery, investor protection, company support, and economic growth of India.

1. Introduction to Indian Stock Exchanges

Stock exchanges are organised marketplaces where traders and investors buy and sell shares, commodities, currencies, and derivatives. Their dominance is such that between them, they account for almost 100% of the equity trading volume in India. For any entrant, this is quintessential to understand: The Role of BSE and NSE in Trading.

2. Understanding BSE (Bombay Stock Exchange)

Formed in 1875, the BSE is the oldest stock exchange in Asia and one of the fastest exchanges in the world today. The exchange is well-known for its benchmark index SENSEX, which tracks the performance of 30 strong and established companies.

The major contributions of BSE include:

- Providing a trading platform to 5000+ listed companies

- Offering equities, debt instruments, mutual fund listings, and SME platforms.

- Ensuring Transparency Investor Protection

When mentioning The Role of BSE and NSE in Trading, BSE is special in every sense because of its legacy and gigantic network of listed firms.

3. Understanding NSE (National Stock Exchange)

Established in 1992, NSE revolutionised Indian trading by bringing an advanced, electronic trading system. Today, it is the largest exchange in India by trading volume.

Key contributions of NSE are:

- Introducing electronic and algorithmic trading

- Launching the widely tracked index NIFTY 50

- Leading the Derivatives market in India.

- Offering high liquidity and effective price discovery.

While juding the role of BSE and NSE in trading, NSE is usually preferred by traders because it is fast, technologically advanced and has good liquidity.

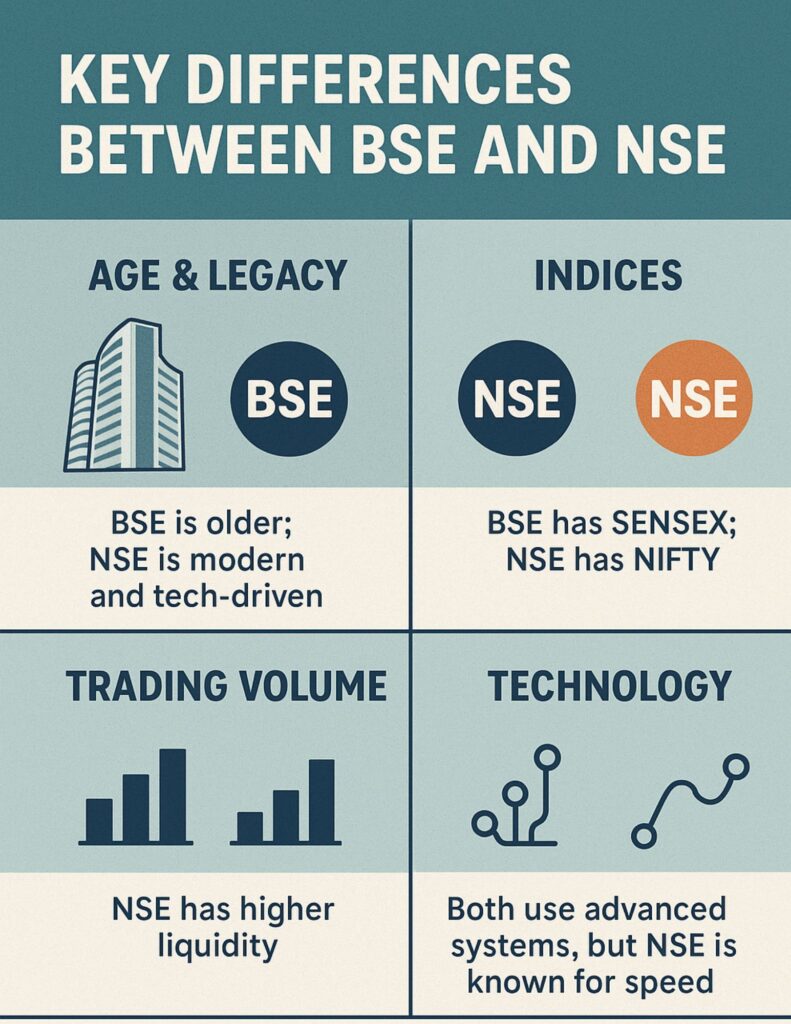

4. Key differences between BSE and NSE

Although both share the same function, they are quite different in many respects:

- Age and Legacy: BSE is older, and NSE is modern and technology-driven.

- Indices: BSE has SENSEX, NSE has NIFTY

- Trading Volume: NSE has higher liquidity.

- Technology: while both are advanced systems, NSE was known for speed.

- Investor Preference: Retail investors explore both, whereas traders predominantly prefer the NSE.

Understanding these differences helps in clearly analysing The Role of BSE and NSE in Trading from both a historical and practical perspective.

5. How BSE & NSE Support the Trading System

a. Transparent Marketplace

Both exchanges have a completely transparent order-driven trading system. Real-time data, strict regulations, and surveillance mechanisms ensure that trading is fair. This represents a part of The Role of BSE & NSE in Trading.

b. Efficient Capital Formation

BSE and NSE permit various companies to raise funds through IPOs, rights issues, and debt listings. This allows growth for a business while providing the opportunity for investors to participate in the country’s economic progress.

c. High Market Liquidity

ons quickly. The NSE especially provides high liquidity in equities and derivatives. One of the most important parts of The Role of BSE and NSE in Trading is liquidity.

d. Market Stability Measures

Both exchanges apply:

- Circuit breakers

- Price bands

- Real-time monitoring

- Risk management systems

These steps ensure market stability and safeguard investors against extreme volatility.

e. Clearing & Settlement

Both exchanges use clearing corporations to guarantee settlement, reducing counterparty risk and making for smooth execution, an important part of The Role of BSE and NSE in Trading.

6. How BSE & NSE Affect Retail Traders

Retail traders benefit directly from:

- Access to the thousands of listed companies

- Opportunity to trade equities, futures, options, and currencies

- Reliable price discovery

- Low transaction costs

- Safe and Regulated Trading Environment

Generally, retail investors come across the concept of The Role of BSE and NSE in Trading when they execute trades for the first time and see how both the exchanges function in real time.

7. How BSE & NSE Support Institutional Investors

The institutional investors rely extensively on BSE and NSE for:

- Bulk deals

- Block deals

- High-frequency trading

- Portfolio diversification

- Lower impact costs

Such exchanges enable the institutions to place heavy orders without disrupting the whole market structure. This is one of the reasons why institutional participation makes The Role of BSE and NSE in Trading so significant for shaping up the efficiency in the market.

8. Contribution to Investor Education

Both BSE and NSE run investor awareness programs regularly. They provide:

- Webinars

- Training modules

- Financial literacy content

- Market insights and reports

They help beginners understand how markets work, which further fortifies the role of BSE and NSE in trading by making informed participation possible.

9. Future of BSE & NSE

The future for Indian exchanges thus seems bright with:

- AI-based market surveillance

- Expansion in derivative products

- Increased retail investor participation

- Blockchain-based settlement possibilities

- Global partnerships

With more Indians investing, increasing investments, the role of the BSE and NSE in trading will also continue to grow by making the markets much safer, quicker, and easier to access.

10. Conclusion

The powerful foundation laid down by BSE and NSE has kept the financial markets in India strong. They offer a secure, transparent, and effective platform where traders and investors can comfortably operate. Whether you are a beginner or a professional trader, learning about The Role of BSE & NSE in Trading is necessary for anyone who wants to gain confidence in stock market trading.

These exchanges do much more than facilitate buying and selling; they build trust, support economic growth, protect investors, and ensure market stability in India. As technology evolves and investor participation grows, the role of BSE and NSE in trading will be of utmost importance in shaping India’s financial future.