Lack of knowledge about the stock market is the main reason why most traders lose money when they enter the stock market. Paper Trading works in India is of great significance in these scenarios, where a beginner gets the chance to learn the art of trading with real market conditions without using real money.

In this blog, we’ll fully grasp what paper trading is, how the process of Paper Trading works in India, how it can be beneficial, what the guidelines are, what mistakes are made during paper trading, and, most importantly, how you can easily switch from paper trading to live trading.

What is Paper Trading in India?

Paper trading is a simulated form of trading where traders buy and sell stocks, options, or futures using virtual money instead of real capital. All trades are executed based on live market prices, but profits and losses are not real.

In simple words, paper trading is like a practice ground for traders before entering the real stock market.

In India, paper trading is widely used by:

- Beginners in the stock market

- Intraday traders

- Options and futures learners

- Students learning technical analysis.

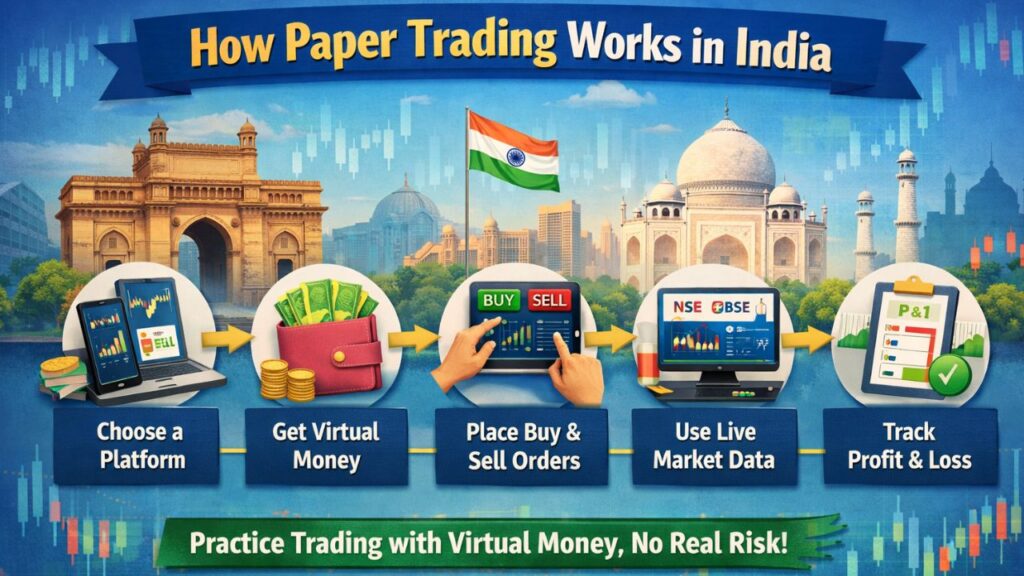

How Paper Trading Works in India

Paper trading works almost the same way as real trading, except that money is virtual.

Here’s how it functions:

- You choose a paper trading platform.

- You get virtual capital (example: ₹5,00,000 or ₹10,00,000)

- You place buy and sell orders based on live NSE or BSE prices.

- Your profit and loss is calculated basically.

- No real money is involved.

You can turn in:

- Equity

- Intrad

- Futures

- Options

- Index (Nifty, Bank Nifty

It assists traders in understanding market movement, order execution, and trading strategy.

Importance of Paper Trading to Indian Stock Market Investors

1. Risk-Free Learning

Paper trading is an ideal way to learn how to trade without spending any cash. It’s good to start learning and practising on paper first before you venture

2. Understanding Indian Market Behaviour

Indian markets have unique volatility, especially in Bank Nifty and options. Paper trading helps you understand behaviour.

3. Builds Trading Discipline

You learn to follow:

- Entry rules

- Exit rules

- Stop-loss discipline

4. Improves Decision-Making

With continuous practice, your ability to analyse charts and make decisions improves.

5. Confidence Building

Paper trading builds confidence before moving into live trading.

Paper Trading-Who Should Do It?

Paper Trading works in India is used for:

- Beginning investors in the stock market

- University students

- Job seekers who are in search of trading careers

- Intraday traders

- Beginner’s option and futures

- Testing novel strategies by traders

Paper trading is not optional if you’re new to the market; it’s required.

Paper Trading in Different Market Segments

- Equity Paper Trading

Practice buying and selling stocks listed on NSE and BSE.

- Intraday Paper Trading

Learn intraday strategies like scalping, breakout, and momentum trading.

- Futures & Options Paper Trading

Understand lot size, margin, premium decay, and option Greeks.

- Index Trading

Practice Nifty and Bank Nifty trading, which is highly popular in India.

- Swing Trading

Learn holding positions for multiple days using technical analysis.

Best Paper Trading Platforms in India

While choosing a paper trading platform, look for:

- Live market data

- Easy order execution

- Equity, F&O support

- P&L tracking

- Trading journal

Both free and paid platforms are available. Paid platforms usually offer better data accuracy and advanced features.

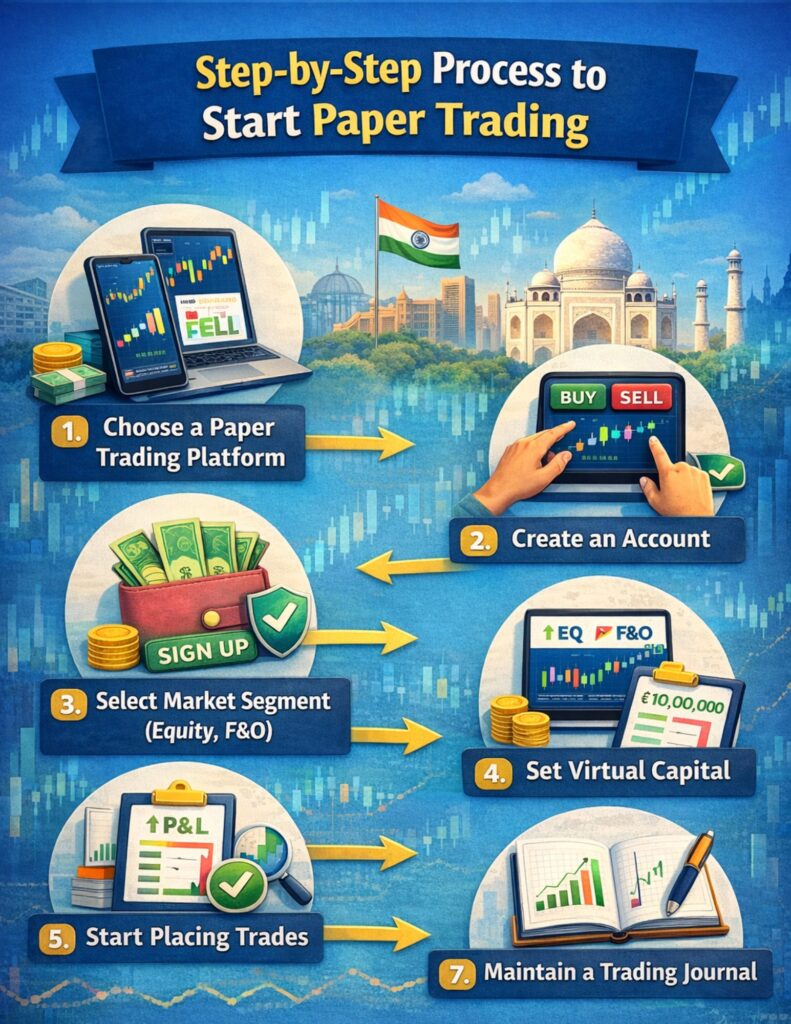

Step-by-Step Process to Start Paper Trading

- Choose a paper trading platform.

- Create an account

- Select your market segment (equity, F&O)

- Set virtual capital

- Start placing trades

- Track profit & loss

- Maintain a trading journal.

Consistency is more important than random trading.

Rules to Follow During Paper Trading

To get real benefits, follow these rules:

- Treat virtual money like real money.

- Use proper stop-loss

- Follow fixed position sizing.

- Trade only with a strategy

- Avoid overtrading

- Analyse every trade

Paper Trading works in India without rules is time wasted.

Common Mistakes in Paper Trading

Many traders fail even after paper trading due to these mistakes:

- Taking huge positions because money is virtual

- Ignoring stop-loss

- Random trades without logic

- Overconfidence after virtual profits

- Not tracking performance

Paper Trading works in India should be treated as real trading practice, not a game.

How Long Should You Do Paper Trading?

There is no fixed time, but ideally:

- Minimum: 2–3 months

- Track consistency, not luck

- Focus on the risk-reward ratio.

- Check drawdown control

Once you become consistent, you can slowly move to live trading.

Transition from Paper Trading to Live Trading

Shifting from Paper Trading works in India to real trading is a critical phase.

Tips for smooth transition:

- Start with a small capital.

- Trade with 1 lot or a minimum quantity

- Expect emotional pressure

- Stick to the same strategy.

- Focus on process, not profit.

Remember, real trading tests psychology more than strategy.

Limitations of Paper Trading in India

Paper Trading works in India is helpful, but it has limitations:

- No real emotional pressure

- Slippage is not realistic.

- Order execution may differ.

- Overconfidence risk

Thats why Paper Trading works in India should be combined with proper education and live market guidance.

Is Paper Trading Enough to Become a Profitable Trader?

No Paper trading allows you to:

- Learn the basics.

- Testing plans/strategies

- Be more confident

All you need, however, to make it profitable are:

- Strong technical knowledge

- Risk management

- Psychology of trading

- Live market experience

Paper trading is a starting point, never a destination.

Conclusion

Paper Trading works in India is one of the best means for learning stock market trading without any financial risk. It basically helps in making beginners comprehend the market, build discipline, and acquire confidence. But in reality, success comes with trading when paper trading is followed by proper education, mentorship, and controlled live trading.

To survive and grow in the stock market, learn first, earn later.

FAQs on Paper Trading in India

1. Is Paper Trading works in India?

Yes, paper trading is completely legal in India as it involves virtual money and no real transactions.

2. Can beginners start with paper trading?

Yes, paper trading is highly recommended for beginners before real trading.

3. How much virtual money should I use in paper trading?

Use a realistic amount similar to what you plan to invest in real trading.

4. Is paper trading useful for options trading?

Yes, it is very useful for learning option strategies, lot sizes, and risk management.

5. When should I move from paper trading to real trading?

Once you achieve consistent results, follow risk management, and control emotions, you can shift to live trading with small capital.